Podcast:

The Importance of Resilience.

CT Automotive Founder & CEO, Simon Phillips tells his story on the ‘In the Company of Mavericks Podcast’

Listen to the Podcast

Find out more about our board and executive commitee

Click HereFounded in 2000, CT Automotive’s success is built on its low-cost manufacturing offer combined with the strength of its strategically placed distribution and logistics centres.

The Group boasts a global manufacturing footprint and wholly owned production infrastructure, with facilities in China (two), Turkiye, Czechia, and Mexico. The Company also has sales and distribution capabilities in the UK, US, Europe and Japan. In India, the Group has an engineering design office, global supply chain centre and corporate centre and administration centre.

A specialist supplier of interior automotive components for the world’s leading OEMs and Tier-1 manufacturers, the CT Automotive supplies components and interior trims across 55 different models for 22 Original Equipment Manufacturers (“OEM”). The Group’s range encompasses products such as decorative finishes, air vents, arm rests and wrapped assemblies, mechanical assemblies and light guides working collaboratively with customer to customers’ needs. The Group is focused on driving innovative design leading and engineering solutions to deliver manufacturing excellence efficiently and sustainably.

CT Automotive has strong and long-standing relationships with a number of Tier One suppliers and OEMs including Marelli, Faurecia, Ford and Rivian and other major EV brands. The Group maintains strategic relationships with all of its key customers and will typically supply multiple platforms for each customer.

Through the combination of long-standing customer relationships and the integration of the Group’s products to the vehicle design, the Group aims to become embedded within customer supply chains and product development to progressively expand the range of products supplied. The Group is set to benefit from the increase in interior automotive content as the vehicle interior environment is rapidly becoming a key product differentiator.

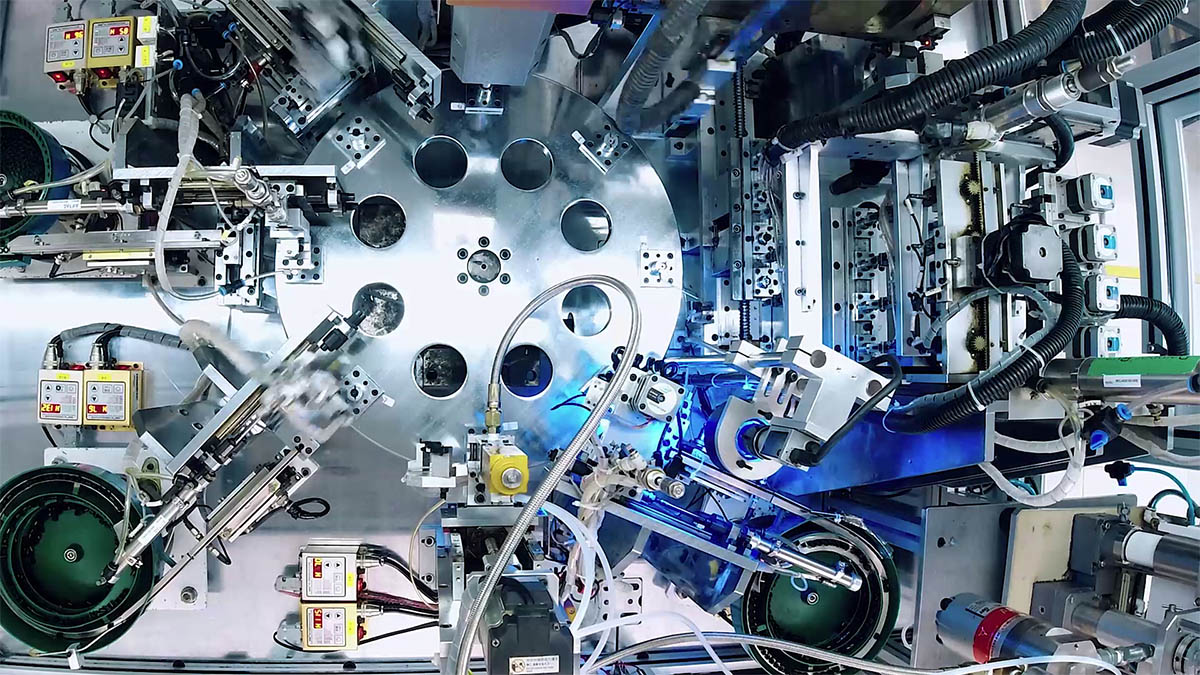

Technology

CT is an early adopter of technology, incorporating robotics and automation into our manufacturing operations, as well as AI driven processes to reduce our fixed cost structure whilst increasing consistency and quality of our products.

Experienced Management Team

Simon Philips co-founded CT Automotive in 2000 having identified an opportunity to disrupt the automotive tooling market. The Group boasts an experienced executive management team with a track record of delivering long-term organic revenue growth.

A niche market and high barriers to entry

The automotive interior components market is valued at $6.5 billion annually and characterised by high barriers to entry. Customers’ stringent on-boarding requirements and risk aversion around supply chain and product quality means that they are generally locked in over long product cycles.

Low-cost operating model delivering global reach

CT Automotive’s consistent focus on delivering a low-cost operating model delivers a significant competitive advantage. Its core manufacturing and design operations are based in emerging economy low-cost regions such as China, Mexico and Turkey enabling the Group to benefit from relatively lower cost production processes, labour and plant hardware whilst maintaining high quality production. Facilities are located for the benefit of customers whilst an integrated supply chain keeps costs low, improves development lead times and increases flexibility.

Embedded relationships deliver visibility of long-term earnings

The Group has a strong track record of customer retention, and long-standing embedded relationships. The components produced by CT Automotive are designed with bespoke tooling for each part and the Group is typically the sole supplier over multiple-year vehicle production cycle. This gives the Group good visibility over future production revenue.

Low market penetration and opportunity to gain market share

The Group is currently supplying components across 55 models to 22 global OEMS, however there remains significant opportunity to expand supply to new programs for existing customers as well as to win new customers.

Strong Track Record

The Group has a strong track record for consistently delivering high quality products. CT’s relentless pursuit of manufacturing efficiencies and cost reduction ensures we offer the best possible terms to our customers

The provisional financial calendar is shown below:

February 2026 – Trading update

April 2026 – 2025 Results announcement

June 2026 – AGM

September 2026 – 2026 Half-year results announcement

Download CT Automotive Annual Report 2024

Download CT Automotive Annual Report 2023

Download CT Automotive Annual Report 2022

Download CT Automotive Annual Report 2021

Download Articles of Association Document

Download Term of reference for audit and risk committee

Download Terms of reference for remuneration committee

Download CT Automotive Group Plc Circular 28 April 2023

Download Terms of reference for ESG Committee

AGM 2025

2025

2024

Download CT Automotive (CTA) interim results presentation – September 2024 PDF

Raymond Bench – Non-Executive Chairman

Ray has worked in the global automotive industry for the past 30 years; 12 of which were spent working for a Chinese OEM. He is an experienced automotive design engineer with extensive knowledge of automotive design processes.

Ray has significant experience of business and departmental management, including having been part of Shanghai Motor UK Technical Centre’s UK senior leadership team. Ray’s experience also includes leadership roles at Ricardo, Rover Group, and Land Rover.

Geraint Davies – Senior Independent Non-Executive Director, Chair of Audit and Risk Committee

Geraint is a Chartered Accountant with over 30 years’ experience as a Partner in the “Big Four” accounting firms, working principally with global businesses in manufacturing, real estate, mining, distribution and financial services. Prior to his appointment, Geraint held senior leadership roles in EY’s practices in the Channel Islands, the UK, and most recently in Malta. He has also previously held roles with PwC and Deloitte. Throughout his career, Geraint has had specific responsibility for risk, both at regional and national level, as well as leading on talent development and senior recruitment.

Simon Phillips – Founder, Chief Executive Officer

Simon co-founded CT Automotive in 2000 in the UK having identified an opportunity to disrupt the automotive tooling market which at that time was primarily centred in Europe. He soon led a move to relocate the business to China where the Company could manufacture in a lower cost environment but to high standards. A successful combination which supported the growth of the business helping to transform CT Automotive from its tool-making roots into the global serial production operation it is today serving many of the world’s largest automotive OEMs.

Simon has an engineering background having studied Mechanical Engineering at Portsmouth University, with a specific emphasis on sub-sonic to super-sonic flight.

CT Automotive manages its operations with the future in mind and adheres to the highest levels of corporate governance and responsible conduct practices. The Board leads the Company and ensures it is on the correct track to grow sustainably to benefit all its stakeholders as well as the communities it operates in. The Directors support high standards of corporate governance and have adopted the QCA Code. Details of how the Company complies with the QCA Code are detailed in the Principles page.

The audit and risk committee determines and examines matters relating to the financial affairs of the Company including the terms of engagement of the Company’s auditors and, in consultation with the auditors, the scope of the audit. It will receive and review reports from management and the Company’s auditors relating to the half yearly and annual accounts and the accounting and the internal control systems in use throughout the Company. The audit and risk committee also advises the Board on the Group’s overall risk appetite and strategy including, inter alia, regularly reviewing and updating (if appropriate) the risk assessment processes in place, including in relation to remuneration and compliance functions, and assisting in overseeing implementation of the adopted strategy.

Members: Geraint Davies (Chair) and Raymond Bench

The remuneration committee reviews and make recommendations in respect of the Executive Directors’ remuneration and benefits packages, including share options and the terms of their appointment. The remuneration committee also makes recommendations to the board concerning the allocation of share options to employees under the company’s share option schemes.

Members: Raymond Bench (Chair) and Geraint Davies

The ESG Committee has been established in 2025 to assist the Board in promoting the long-term sustainable success of the Company with regard to ESG matters. In particular the Committee will oversee the development of the Company’s ESG strategy and monitor its performance in relation to ESG matters through oversight of key ESG KPIs and objectives. The Committee will review the Company’s reporting of its ESG matters and the ongoing effectiveness of the Company’s non-financial ESG-related policies and procedures. Additionally the Committee will be responsible for the development of the Group’s Corporate Social Responsibility policy and framework.

Members: Raymond Bench (Chair) and Geraint Davies

The board consists of one executive and two non-executive directors. The Board of Directors provide various perspectives through their different skills and experiences.

The Company has adopted the QCA Corporate Governance Code and has assessed compliance with the Principles set out in the updated QCA Code issued in 2023. A summary of our disclosures for each Principle are explained below.

Principle 1: Establish a purpose, strategy and business model which promote long-term value for shareholders

Our strategy and our business model are driven by our purpose and further information relating to our medium and long-term strategy can be found on our website page Home and contained in the section of our Annual Report entitled Strategic Report on pages 7 – 43 which can be found here.

Details of the principal risks affecting the business which have been identified by the board can be found in the section of our Annual Report entitled Principal Risks and uncertainties on pages 20- 47 here.

Principle 2: Promote a corporate culture that is based on ethical values and behaviours

The culture of CT is embodied by the actions and leadership of our Board and our senior executives who ‘lead by example’. We have an established set of values which promote ethical behaviours throughout the Group and underpin our purpose to drive innovative design and industry leading engineering solutions to deliver manufacturing excellence, efficiently and sustainably. For further information regarding our culture and values please see the Chair’s governance statement on pages 45 to 51 of our Annual Report here.

Principle 3: Seek to understand and meet shareholder needs and expectations

The Board regularly engages with shareholders and other stakeholders. The Group’s reporting of non-financial matters has significantly increased over the last two years and can be found in our Non-financial and sustainability information statement on pages 30 to 43 of our Annual Report here.

Principle 4: Take into account wider stakeholder interests, including social and environmental responsibilities, and their implications for long-term success

The Board recognises its responsibility to promote the Company’s success for the benefit of its stakeholders and understands that the business has a responsibility towards its shareholders, employees, customers and suppliers and to the local communities in which we operate. The Non-financial and sustainability information statement on pages 30 to 43 of our Annual Report here sets out our approach to environmental social and governance issues and relevant associated KPIs used to track our performance on such matters and establish key forward-looking targets.

Principle 5: Embed effective risk management, internal controls and assurance activities, considering both opportunities and threats, throughout the organisation

The Board regularly reviews the framework of risk management, the specific risks and opportunities facing the Group, sets the risk appetite of the Group and records these in the Risk Register. Details can be found in the section Principal Risks and uncertainties on pages 20 to 27 of the Annual Report here and the report of the Audit and Risk Committee on pages 52 to 56 of the Annual Report here. The Audit & Risk Committee monitors auditor independence at the planning stage of the audit and again when the Report and Accounts are approved. The Company has adopted a policy on Auditor Independence and the provision of Non-Audit Services which is adhered to.

Principle 6: Establish and maintain the board as a well-functioning, balanced team led by the chair

Relevant information is set out in the Chair’s statement of corporate governance on pages 45 to 51 of the Annual Report here and on our website in the section entitled Governance here. The Board comprises one executive director and two non-executive directors, both of which are considered independent, including Ray Bench who was considered independent on his appointment as Chair and remains so.

Principle 7: Maintain appropriate governance structures and ensure that individually and collectively the directors have the necessary up-to-date experience, skills and capabilities.

Full details of our governance structures can be found in the Chair’s governance statement on pages 45 to 51 of our Annual Report here and on our website in the section Governance here. There is a formal schedule of matters reserved for the Board which can be found on our website and the Audit & Risk Committee, Remuneration Committee and ESG Committee each has responsibilities set out in their terms of reference which can be found on our website. A report from each of the Audit and Risk Committee and the Remuneration Committee on their activities throughout the year can be found on pages 52 and 57 respectively here.

Principle 8: Evaluate Board performance based on clear and relevant objectives, seeking continuous improvement

Details of the latest board performance review, conducted in early 2025 is set out on page 50 of the Annual Report in the section entitled Board Responsibilities here and includes the results and recommendations of that review and progress made against previous recommendations.

The Group has recently adopted a more formal organisational structure to give clarity to succession planning and the Board has considered succession planning for key roles.

Principle 9: Establish a remuneration policy which is supportive of long-term value creation and the Company’s purpose, strategy and culture

The Remuneration Committee report, including the Group’s remuneration policy, can be found in the Remuneration Committee report on page 57 in the Annual Report here.

In line with best practice, the annual remuneration report was put to an advisory shareholder vote at the Company’s 2025 Annual General Meeting.

Principle 10: Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other key stakeholders

The Chair’s statement and the CEO’s statement on pages 11 and 13 of the Annual Report here details the challenges faced by the Group in 2024 and how these were addressed. Reports of the activities of each of the Audit and Risk committee and the Remuneration Committee can be found on pages 52 and 57 of the Annual Report here. The result of our Annual General Meeting and other shareholder votes are disclosed via RNS.

| No. of Ordinary Shares held | Percentage of issued share capital | |

|---|---|---|

| Simon Phillips | 19,702,454 | 26.77% |

| LGT Bank, Vaduz | 19,219,752 | 12.53% |

| Otus Capital Management | 6,980,012 | 9.48% |

| Premier Miton Investors | 5,729,875 | 7.79% |

| Charles Stanley | 5,399,032 | 7.34% |

| Stonehage Fleming | 5,589,676 | 7.59% |

| Pitharn Ongkosit | 2,697,267 | 3.66% |

| Lombard Odier Investment Managers | 2,674,551 | 3.63% |

| Scott McKenzie | 2,244,758 | 3.05% |

| Directors | No. of ordinary shares held | Percentage of issued share capital |

| Simon Phillips | 19,702,454 | 26.77% |

| Ray Bench | 67,303 | 0.1% |

| Geraint Davies | 80,000 | 0.1% |

There are 73,597,548 shares in issue. 39.5% per cent of shares are not in public hands.

Last reviewed – 28 January 2026

Media Enquiries

investors@ct-automotive.net

Company Secretary

Sarah Jacobs

CT Automotive Head Office

1000 Lakeside North Harbour

Western Road

Portsmouth Hampshire

P06 3EN

Nominated Advisor and Sole Broker

Singer Capital Markets Advisory LLP

One Bartholomew Lane

London

EC2N 2AX

Legal advisers to the Company

Fieldfisher LLP

Riverbank House

2 Swan Lane

London

EC4R 3TT

Auditors

MHA Audit Services LLP

Member of Baker Tilly International

The Pinnacle,

150 Midsummer Boulevard,

Milton Keynes

MK9 1LZ

Registrars

Link Market Services Limited

10th Floor, Central Square

29 Wellington Street

Leeds

Creating a sustainable business that allows all of our stakeholders to prosper

The Directors recognise the importance of Environmental, Social and Governance (ESG) and the Group is committed to adopting best practice actions and reporting. CT Automotive’s focus on a leadership strategy co-exists with a strong commitment to the safety and welfare of staff, a sustainable approach to environmental practices, and a strong governance framework.

The following key areas comprise CT Automotive’s strategy on sustainability:

We are delighted to be awarded a Silver Medal by EcoVadis, the world’s largest provider of sustainability ratings to assessed businesses. Our score ranks us in the top 15% of all companies rated by EcoVadis.

The Group is committed to managing the environmental impact of its activities, reducing pollution and promoting cleaner production processes. The Group is actively managing its environmental objectives through its Environment Management System ISO 14001 which has been introduced at all of its operational sites, encompassing Group activities and all stakeholders throughout the supply chain.

CT Automotive initiatives include:

We believe that our people are critical to our success and recognise that success hinges on the attitudes and behaviours of employees. CT Automotive strives to create a working environment and a culture that encourages them to deliver an outstanding performance for customers whilst operating with uncompromising ethics. The Board is committed to supporting their performance, wellbeing and personal development and places great importance on engaging directly with local management and employees.

We are committed to Health and Safety and dedicated to preventing injuries and health issues amongst our employees and visitors to our sites. We embrace the ‘come safe, work safe and go safe’ principle and we view our responsibility to provide a safe, clean work environment as fundamental.

We care about what our employees think and are keen to learn how we can improve our organisation. To that end we conduct workplace surveys across all our operating sites.

CT Automotive supports diversity and equality, employing a workforce that spans various ages, gender, disabilities, ethnicities and religions. The Group is pleased to report that the number of women represented in its workforce continues to increase across its operational sites, with women representing 52% of the total workforce in 2024. The Board is also proud to say that the overall average gender pay gap for the Group in 2024 was 0.36%

Governance is central to delivering on our strategy and the successful operation of our business and we continue to improve our governance processes and procedures with a focus on the on ESG impact of the Group’s activities.

In recognition of the importance of sound corporate governance the Board has adopted the QCA Code which is considered the most appropriate for the Group’s size and stage of development. The Board considers that the Group remains compliant with the Principles set out in the QCA Code and further details can be found here.

The board consists of one Executive and two Non-executive Directors. The Board of Directors provide various perspectives through their different skills and experiences. The Board recognises that the success and growth achieved to date is underpinned by the wealth of experience within its Senior Leadership Team, a fully cross-functional team spread across the Group’s key locations to provide maximum operational oversight.

The information contained within this section of this website is disclosed for the purposes of AIM Rule 26.

Commercial DepartmentrnProgram Management

Program ManagementrnCommercial DepartmentrnPainting & FinishingrnInjection MouldingrnKinetic Assembly

Interior Trim Wrap PanelsrnTest & Validation CentrernProgram ManagementrnCommercial DepartmentrnEngineering & Quality Support TeamsrnInjection MouldingrnGuage & Tooling Mfg.rnDesign & DevelopmentrnKinetic AssemblyrnChrome Paint Finishing

Manufacturing, Engineering & Quality Support teams

Engineering & Quality Support TeamsrnInjection MouldingrnKinetic Assay

Engineering & Quality Support Teams

Engineering & Quality Support Teams

Engineering & Quality Support Teams

Engineering & Quality Support Teams

Design & Development

Manufacturing, Engineering & Quality Support teams

Manufacturing, Engineering & Quality Support teams

Design & Development